Debt Management Program

A debt that is not paid within the terms of repayment goes into default i.e. you are in default of your repayment obligation. Debt negotiation and settlement worked best with unsecured debts (Credit cards & Loans).

One of the most unsettling aspects of being in debt is dealing with the demands and threats from your creditors – the people you owe money to. By taking advantage of a Debt Management Plan from Trinity credit solution, we can help REDUCE THE WORRY by dealing with your creditors for you. Enabling you to concentrate on repaying your debt at a realistic, affordable rate.

A debt management program (also called a debt management plan) helps you pay off your debt to multiple creditors with a single, comfortable monthly payment. If you’re interested in a debt management program, you’ll first consult Trinity credit Solution.

We will provide basic credit counseling session, which is offered online, via phone, or in person. We will review your total financial situation and discuss your credit report, income and expenses, and debt score with you. We will take inventory of your outstanding debts and creditors, and we explain how a DMP may work for your specific situation, including how your interest rates and monthly payments may change on the program.

WE CAN DO

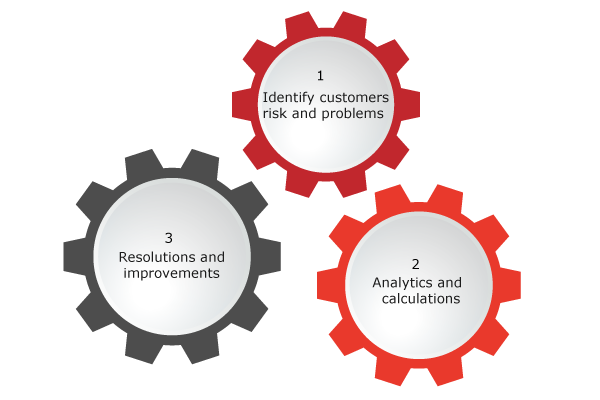

On obtaining the credit card/Loans details from you we can find out the exact outstanding as of today.

Once we know the exact outstanding, we will inform the bank about your intensions to close the account and start the negotiation process with the bank. We will try to get the overdue charges and the other interest charges on your account waived.

On arriving at a final settlement amount, we will take your acceptance on the amount and the mode of payment post which we will ask the bank to give us the final settlement letter.

On obtaining the final settlement letter we will ask you to organize and make the payment to the bank. On completion of the settlement we will liaison with the bank.